Relo 101 for Companies with Smaller Relocation Volumes

If your company doesn't frequently relocate many employees, you may feel that keeping up to date on the latest practices for delivering a successful and seamless relocation experience for your employees is challenging.

Relocations involve a significant investment, often reaching up to three times an employee's salary. This investment is made to support your company's goals and growth. Ensuring that your organization can effectively manage its budget, provide employees with the smoothest relocation experience possible, and meet your relocation objectives is critical.

Why is a smooth relocation important?

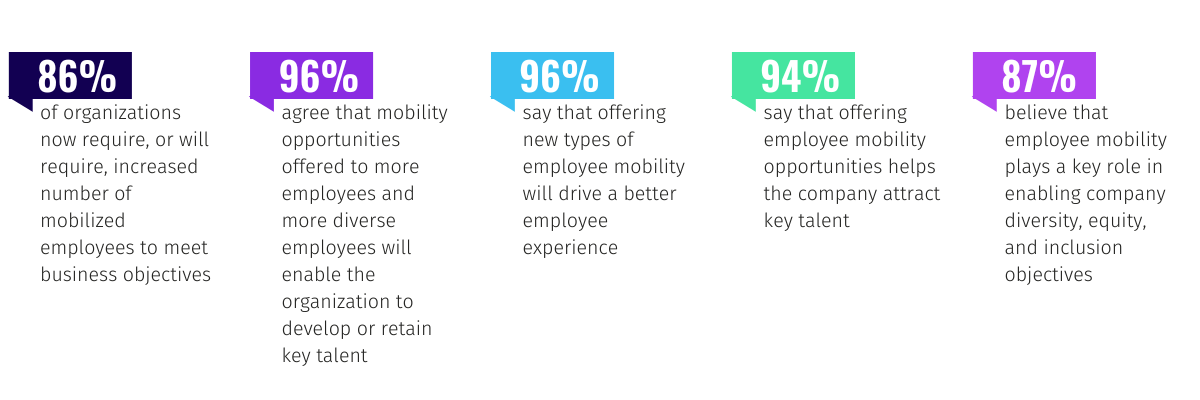

In addition to maximizing your company’s return on investment (ROI), there are other significant reasons to design and deploy a successful relocation program. In a recent Sirva pulse survey, The Growth of the Employee Mobility Function:

|

We recommend services that support your employees’ assimilation into their new environments. A smooth transition supported by sound mobility practices supports employee success which, ultimately, translates to the success of your company.

What should companies know about relocation?

There are a variety of relocation terms and concepts your stakeholders that are involved in relocation support should be familiar with.

Pre-Decision Counseling: Relocating to a new area, whether across town or across borders, involves big changes. To ensure that a proposed relocation will be the right fit for both employees and their families, counseling services should be offered to present a detail-oriented look at the new location, your company’s relocation policy, available benefits, and any significant cultural or financial implications related to the proposed move. You should also provide any resources that would be available to the family for gaining further information.

Home Finding: Presenting families with pre-screened properties and targeted community searches based on a comprehensive needs analysis is wise when planning a relocation. This prepares the transferring employee and family, while streamlining the home finding process when they reach the destination location. Defining expectations for a home finding tour and negotiating home leases/purchases through to close are also important components of a successful home finding process.

Household Goods: There is a great deal to coordinate when it comes to moving and storing an employee’s household goods. This includes ensuring that the shipment is properly surveyed, packed, loaded, shipped, and delivered. Items that will be placed into storage at the origin location should also be monitored to ensure that they are being placed in a secure facility and that the weight and size fall within the parameters of your policy to avoid any misunderstandings or unnecessary claims upon repatriation.

Home Sale Programs: In cases of U.S. domestic relocations, the purpose of home sale programs is to assist the employee on proper listing placement to ensure the home sells as quickly as possible for the highest dollar amount, while also insulating the employee from having to pay taxes on the reimbursement of home sale costs. There may also be a buyout option to provide employees with peace of mind; if their homes don’t sell in a reasonable period of time, they will be free from responsibility. This may be important if an employee is attempting to purchase a home in the destination location and cannot because s/he still owns a home in the location of origin.

| Flexible home sale program options should be available to meet the varying needs and circumstances of relocating employees. At Sirva, for example, we offer several levels of pre-decision consulting services to assess need and provide flexibility, with programs available that are based on broker/appraisal information, broker price opinion, or “drive-by” appraisals, depending on the scenario. |

Final Move: In cases of U.S. domestic relocations, when an employee hasn’t yet closed on a new home or his/her household goods may not have arrived, accommodations must be made to support the individual and his/her family. Services include one night of accommodations in the location of origin (when the employee’s household goods have been loaded up and are no longer at the home), mileage at the IRS rate, or airfare depending on the distance to the new location, meals in transit on a per diem basis, and hotel accommodations for the first night in the new location.

Temporary Housing: Often, temporary housing will need to be arranged before an employee can move into his or her long-term home. After conducting a formal needs assessment and interviews to identify appropriate properties, the employee and family should receive guidance on the execution of lease agreements, any laws or standards specific to the new country or region, and the coordination of move dates and services. If working with a relocation management company (RMC), all of this can be outsourced, along with direct billing and the management of any ongoing concerns with the property during the employee’s stay.

Miscellaneous Allowance: The miscellaneous allowance is intended to cover portions of the relocation that may not be covered by your standard relocation package. Examples may include moving pets, licensure issues, miscellaneous items needed to set up the new home, etc. The miscellaneous allowance is intended to reduce exceptions to your policy. This is typically grossed up and your RMC can assist with establishing the amount of the allowance.

Visa & Immigration: The coordination and execution of employee and family work permits, visas, business travel visas, and training permits is complex, and the requirements vary and change rapidly from country to country. Compliance with all regulations (before and during the assignment, and upon repatriation) is crucial.

Destination Services: From area orientation, school search assistance, and settling-in services to spouse/partner assistance, arranging destination services at the employee’s host location is crucial to his/her success on assignment. Working with an RMC that has global reach guarantees that these services will be provided with both expertise and personalization, including nightly check-ins with the employee, targeted community searches, area tours, and guidance on everything from local social mores to local housing market trends.

Expense Management: In addition to tracking all relocation expenses for tax and budget purposes, your company gains a distinct advantage when managing expenses and tracking them for the projection of expenses on future relocations. One advantage of working with an experienced RMC is that its finance team, aligned with the company’s account team, can perform all services for expense audit and reimbursement, tax calculations and gross-up, payroll interface, and reporting. At Sirva, convenient online and mobile platforms allow transferring families to submit expense vouchers from anywhere in the world, using any device.

How can you create a relocation program designed around your company’s needs?

A best-in-class relocation program should always consider your company’s culture, budgets, and recruiting practices. Be sure to engage stakeholders across your organization from HR, IT, Legal, and business unit leadership and consider the following areas.

Relocation Expenses

As your company considers external partners, decision makers should determine whether each passes all direct costs, associated with vendors within their networks, through at cost or marks those costs up. Transparency regarding ongoing or additional fees that might be incurred is also crucial if the partners don’t operate by charging one-time fees.

Tax Liability/Compliance

Systems of taxation vary greatly from country to country, which means the need to understand tax liability and compliance is crucial in every location where your company is conducting business. Variations can create the potential for income that is taxed in two different countries or not taxed at all, or in which one country may calculate tax on local income only, while another may impose tax on worldwide income. Within any tax compliance system, companies can minimize their tax liabilities by employing the help of domestic and international tax specialists, an area that is often a focus among specialized lawyers and accountants.

Benefits of Outsourcing

In a past blog post, We’re a Small Company: Is it Worth Outsourcing My Mobility Program? we discussed a variety of benefits that are available to companies when they outsource their relocation programs. We encourage you to read the post for a wealth of helpful information. In short, in addition to creating more efficient mobility programs that reduce company costs and concerns, outsourcing to a partner that provides services that are tailored to organizations that don’t move a lot of employees provides:

- Immediate access to industry knowledge and best practices

- An extension of your existing internal teams

- Streamlined planning, implementation, and support of global mobility relocations and programs

How can Sirva help?The benefits of getting support to implement a program tailored to your company’s needs has a variety of benefits worth pursuing, from efficiency and productivity to fully engaged employees and a positive impact on your bottom line. If your company moves fewer than 50 employees a year, learn more about the many ways Sirva’s Advantage program could benefit your company. |